The 4-Minute Rule for Hsmb Advisory Llc

The 4-Minute Rule for Hsmb Advisory Llc

Blog Article

Hsmb Advisory Llc Can Be Fun For Everyone

Table of ContentsNot known Details About Hsmb Advisory Llc A Biased View of Hsmb Advisory LlcGetting The Hsmb Advisory Llc To WorkThings about Hsmb Advisory LlcHsmb Advisory Llc for DummiesHsmb Advisory Llc Can Be Fun For Anyone

Ford claims to stay away from "cash money value or long-term" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are very complicated, featured high payments, and 9 out of 10 people do not need them. They're oversold since insurance agents make the largest payments on these," he says.

Impairment insurance can be expensive, however. And for those who select long-term care insurance policy, this plan may make handicap insurance policy unneeded. Learn more about lasting treatment insurance coverage and whether it's appropriate for you in the next section. Long-lasting care insurance can help pay for expenditures connected with lasting treatment as we age.

6 Easy Facts About Hsmb Advisory Llc Shown

If you have a persistent wellness worry, this sort of insurance can wind up being essential (Health Insurance). Don't allow it worry you or your bank account early in lifeit's typically best to take out a plan in your 50s or 60s with the anticipation that you won't be utilizing it until your 70s or later on.

If you're a small-business owner, think about securing your livelihood by acquiring organization insurance coverage. In the occasion of a disaster-related closure or duration of restoring, business insurance can cover your revenue loss. Think about if a considerable climate occasion affected your store front or production facilityhow would certainly that affect your income? And for how lengthy? According to a record by FEMA, in between 4060% of small companies never resume their doors following a catastrophe.

Plus, making use of insurance could sometimes set you back more than it saves in the lengthy run. If you get a chip in your windshield, you might think about covering the fixing expenditure with your emergency situation financial savings rather of your vehicle insurance policy. Insurance Advise.

Hsmb Advisory Llc Things To Know Before You Buy

Share these suggestions to safeguard liked ones from being both underinsured and overinsuredand speak with a relied on professional when required. (https://www.goodreads.com/user/show/175903265-hunter-black)

Insurance that is purchased by a specific for single-person insurance coverage or coverage of a family members. The private pays the costs, instead of employer-based medical insurance where the company usually pays a share of the premium. Individuals may buy and acquisition insurance policy from any plans available in the person's geographic area.

Individuals and households may certify for economic help to decrease the cost of insurance costs and out-of-pocket expenses, yet only when registering with Link for Health And Wellness Colorado. If you experience certain changes in your life,, you are eligible for a 60-day period of time where you can register in a private strategy, even if it is outside of the annual open registration duration of Nov.

15.

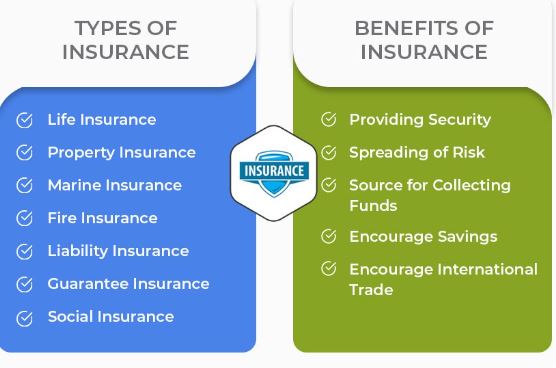

It might appear straightforward however understanding insurance policy kinds can additionally be puzzling. Much of this complication comes from the insurance coverage industry's ongoing objective to design individualized coverage for policyholders. In developing flexible plans, there are a variety to select fromand every one of those insurance policy kinds can make it challenging to recognize what a details plan is and does.

Examine This Report about Hsmb Advisory Llc

If you die during this duration, the individual or people you've named as recipients may get the cash payout of the plan.

However, many term life insurance plans let you convert them to a whole life insurance policy, so you do not shed insurance coverage. Typically, term life insurance policy plan costs settlements (what you pay each month or year right into your policy) are not locked in at the time of acquisition, so every 5 or 10 years you have the plan, your premiums can rise.

They likewise tend to be cheaper general than whole life, unless you get a whole life navigate to this site insurance policy plan when you're young. There are also a couple of variants on term life insurance policy. One, called group term life insurance policy, is common amongst insurance coverage choices you may have access to through your employer.

The Best Strategy To Use For Hsmb Advisory Llc

One more variation that you may have accessibility to via your employer is extra life insurance coverage., or funeral insuranceadditional protection that might help your family in instance something unexpected takes place to you.

Long-term life insurance policy merely refers to any type of life insurance policy plan that does not expire. There are numerous kinds of irreversible life insurancethe most typical types being whole life insurance and global life insurance. Entire life insurance policy is precisely what it sounds like: life insurance policy for your whole life that pays out to your beneficiaries when you pass away.

Report this page